Based on the exploitation of many of Europe's poorest and most vulnerable citizens, and thanks to Malta's generous tax system, Russian and Latvian businessmen enjoy a luxurious lifestyle and a financial burden of almost zero taxes.

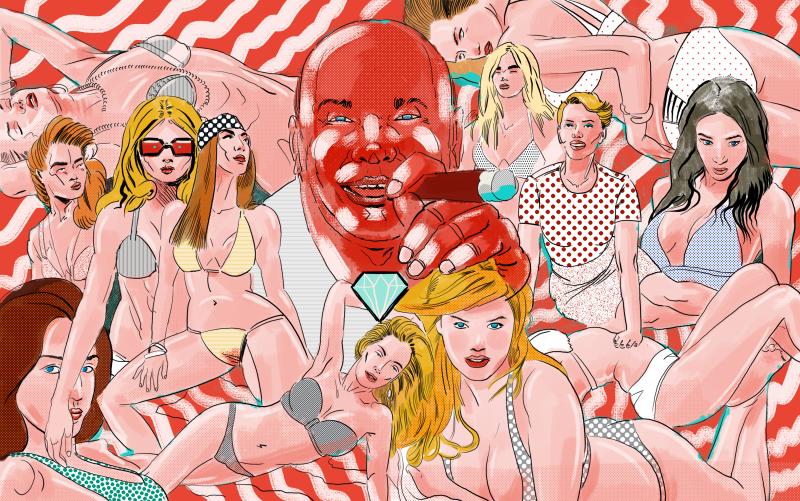

Fashion TV co-owner Oleg Boyko is a Russian billionaire who made his fortune during the former Soviet Union's privatisation frenzy in the 1990s, before moving into gambling, media and financial services. One of his latest big investments is in payday loans, where his companies provide small amounts of money to people in desperate need of cash. Their customers often end up repaying the loans at massive interest rates.

Boyko, 52, is the 75th richest Russian (according to Forbes), although he holds an Italian passport and therefore enjoys all the rights of an EU citizen. He has stashed his fortune in Cyprus and the Bahamas, and in 2011 bought a Latvian start-up, 4finance, which provides quick loans at usurious interest rates in Europe and America.

His company paid at least 105 million euros for shares in this Riga-based company - cash that was distributed through Maltese corporate structures to eight Latvian and Russian founders and beneficial owners. These Maltese companies do not appear to have one single employee and pay no significant corporate tax.

Additionally, 4finance, which is expanding its fast loan business to other continents, has setup a system of loans to its shareholders at 15 per cent interest, through which the parent company siphons off the profits of subsidiaries in many European countries where 4finance operates. In this way, between 2013 and 2015, 4finance Malta Ltd. collected almost €68 million in loan interest and shifted profits from other countries to Malta, where they were transferred to the parent company in Luxembourg.

Another Maltese company owned by Boyko financed a business in the US that offered quick loans with the help of Native American tribes in Montana and Wisconsin. The interest rates could be as high as 700 per cent.

Under the Maltese law and tax practice, all these untaxed or low-taxed financial transfers are legal. This story reveals how Malta, which currently holds the EU presidency, is attracting wealthy people and foreign companies who want to avoid taxation in their own countries.

It shows in minute detail how rich people operate behind companies in tax havens - while their customers face mounting debts, forcing them to leave their home countries to find work to pay the interest on their loans.